Follow the steps mentioned here to create your API key.

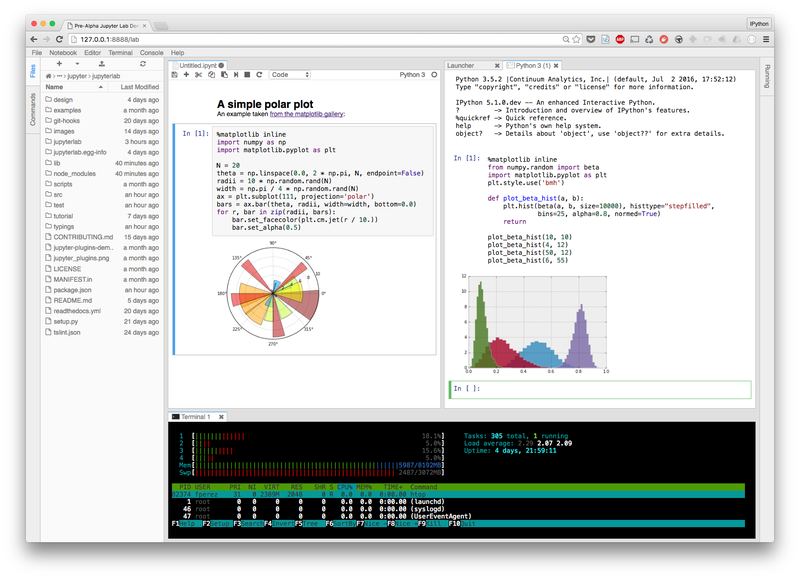

Make sure you have created an account on Quandl. You can create your first notebook by clicking on the New dropdown on the right. Now, your notebook should be running on localhost like the screenshot below:

#Tradingview python jupyter notebook install#

Make sure to brush up on your Python and check out the fundamentals of statistics. You’ll need familiarity with Python and statistics in order to make the most of this tutorial. It is being adopted widely across all domains, especially in data science, because of its easy syntax, huge community, and third-party support. Python is one of the most popular programming languages used, among the likes of C++, Java, R, and MATLAB. It requires profound programming expertise and an understanding of the languages needed to build your own strategy. Quantitative traders at hedge funds and investment banks design and develop these trading strategies and frameworks to test them. So, most traders follow a plan and model to trade. This involves borrowing shares and immediately selling them in the hope of buying them up later at a lower price, returning them to the lender, and making the margin. Traders pay money in return for ownership within a company, hoping to make some profitable trades and sell the stocks at a higher price.Īnother important technique that traders follow is short selling . There is a price at which a stock can be bought and sold, and this keeps on fluctuating depending upon the demand and the supply in the share market.ĭepending on the company’s performance and actions, stock prices may move up and down, but the stock price movement is not limited to the company’s performance. The process of buying and selling existing and previously issued stocks is called stock trading. These stocks are then publicly available and are sold and bought. It is a type of financial security that establishes your claim on a company’s assets and performance.Īn organization or company issues stocks to raise more funds/capital in order to scale and engage in more projects. What Are Stocks? What is Stock Trading? StocksĪ stock is a representation of a share in the ownership of a corporation, which is issued at a certain amount. If you are someone who is familiar with finance and how trading works, you can skip this section and click here to go to the next one. Visualizing the performance of the strategyīefore we deep dive into the details and dynamics of stock pricing data, we must first understand the basics of finance.Formulating a trading strategy with Python.Exploratory data analysis on stock pricing data.We’ll go over the following topics in this post: Someone who is planning to start their own quantitative trading business.A student or someone aiming to become a quantitative analyst (quant) at a fund or bank.You’ll find this post very helpful if you are: This tutorial serves as the beginner’s guide to quantitative trading with Python. It is an immensely sophisticated area of finance. The speed and frequency of financial transactions, together with the large data volumes, has drawn a lot of attention towards technology from all the big financial institutions.Īlgorithmic or Quantitative trading is the process of designing and developing trading strategies based on mathematical and statistical analyses. They can help us gain a competitive advantage in the market. Mathematical Algorithms bring about innovation and speed.

Financial institutions are now evolving into technology companies rather than just staying occupied with the financial aspects of the field. Technology has become an asset in finance.

0 kommentar(er)

0 kommentar(er)